Contemporary blue-chip art represents both cultural significance and intelligent investment, offering collectors access to works by history's most influential artists. Whether you're a seasoned investor seeking proven assets or a first-time buyer entering the sophisticated world of contemporary collecting, understanding blue-chip art is essential for making confident acquisition decisions. This comprehensive guide demystifies the blue-chip contemporary art market, providing the knowledge needed to navigate pricing, authentication, market dynamics, and collection strategies whilst combining aesthetic appreciation with compelling investment characteristics.

What Defines Blue-Chip Contemporary Art? Understanding Value and Legacy

Blue-chip contemporary art refers to works by artists with enduring reputations and proven high market value, analogous to blue-chip stocks in financial markets. These artists demonstrate consistent elevated auction sales over many years, strong institutional support through museum collections and major gallery representation, and widespread critical recognition that has stood the test of time.

By one established market rule, an artist achieves blue-chip status when their works consistently sell for more than $500,000, generate annual sales volumes exceeding $10 million, and maintain auction presence for at least a decade. Artists like Gerhard Richter, Jeff Koons, Yayoi Kusama, and Banksy exemplify this elite category, enjoying international renown, frequent solo exhibitions, and works housed in prestigious museum collections worldwide.

The characteristics that distinguish blue-chip art include established market value and price stability, with works reliably fetching hundreds of thousands to multimillions at auction. Institutional endorsement plays a crucial role – collection by major museums and foundations signals quality and importance to the broader market. These artists have demonstrated historical or cultural influence, having impacted art movements or contemporary trends in meaningful ways.

Scarcity of work drives significant value, particularly for deceased artists where finite output creates increasing rarity over time. This scarcity, combined with consistent global demand from elite collectors, creates the liquidity and price support that characterises blue-chip status. Most importantly, blue-chip art demonstrates remarkable resilience, often appreciating even during economic downturns whilst serving as a valuable portfolio diversifier for sophisticated collectors.

The cultural significance cannot be understated – these works represent pivotal moments in contemporary art history, from Andy Warhol's Pop Art revolution to Banksy's street art disruption of traditional gallery systems. Each blue-chip artist captures something essential about their era whilst creating visual languages that continue to influence subsequent generations of artists and collectors.

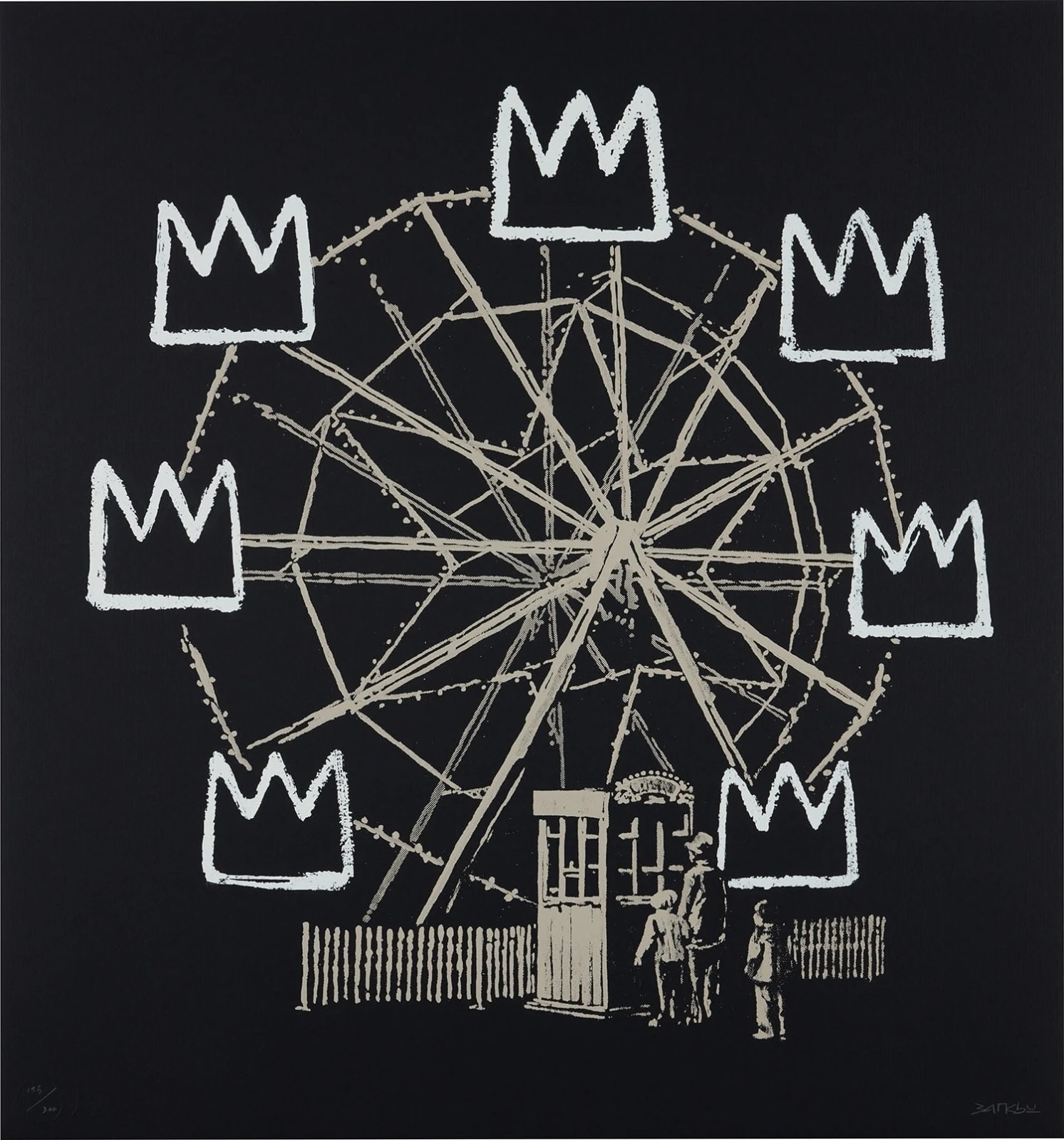

Banksy - Banksquiat available at Calder Contemporary

Why Invest in Blue-Chip Contemporary Art? Beyond Aesthetic Appreciation

Contemporary blue-chip art offers compelling investment opportunities alongside profound aesthetic satisfaction. The Artprice100 index, tracking the top 100 blue-chip artists, has outperformed the S&P 500 since 2000, returning over 360% compared to approximately 247% for equities – suggesting roughly 8-10% annualised returns for art versus 6-7% for stocks over the same period.

Art's low correlation with stock markets provides essential portfolio diversification benefits. During the dot-com crash and 2008 financial crisis, art prices demonstrated resilience, often recovering more quickly than traditional investments. Recently, as inflation reached multi-decade highs, art gained particular appeal as a tangible hedge against currency devaluation, with discerning collectors recognising its defensive characteristics.

The dual nature of art investment – combining financial potential with aesthetic dividend – distinguishes it from purely monetary investments. Unlike stocks, bonds, or commodities, blue-chip art provides daily visual pleasure and cultural prestige whilst building wealth over time. This unique combination means collectors can enjoy living with museum-quality works whilst participating in a historically robust asset class.

Consider the remarkable appreciation potential: a family that acquired a Jean-Michel Basquiat painting for $19,000 in 1984 witnessed it achieve $110.5 million at auction in 2017. Whilst such extraordinary returns represent exceptional cases, they illustrate the transformative potential of blue-chip acquisitions when held over extended periods.

Portfolio diversification through art has gained institutional recognition, with 73% of wealth managers now recommending clients include art and collectibles in their investment strategies. This reflects growing understanding that blue-chip art provides stability during market volatility whilst offering exposure to cultural and creative value creation that operates independently of traditional economic cycles.

The accessibility factor has evolved significantly with contemporary blue-chip art. Through strategic curation of limited-edition prints and multiples, collectors can access iconic works by history's most influential artists at more approachable price points than unique originals. This democratisation allows emerging collectors to build sophisticated collections whilst benefiting from the same market dynamics that drive unique work appreciation.

Navigating the Contemporary Art Market: Key Trends and Expert Insights

The global contemporary art market continues demonstrating long-term strength despite recent adjustments that have created exceptional buying opportunities for discerning collectors. Following the post-pandemic peak of $67.8 billion in 2022, the market's consolidation to $57.5 billion in 2024 represents a healthy correction that has restored balance whilst maintaining historical strength above 2019 levels.

This market adjustment has particularly benefited quality-focused collectors. The flight to quality dynamic strongly favours blue-chip works with impeccable provenance and established market histories. Whilst speculative segments corrected significantly, established blue-chip artists maintained their market positions, demonstrating the defensive characteristics that make them attractive long-term holdings.

Digital transformation has permanently enhanced market accessibility. Online art sales now represent 18% of total market value, with nearly 46% of online dealer sales reaching new buyers. This digital accessibility has expanded the global collector base whilst maintaining the crucial importance of expert curation and authentication that established galleries provide.

Current market conditions favour strategic collectors who work with trusted specialists. The market's emphasis on quality over speculation has reinforced the value of professional guidance in authentication, market timing, and strategic acquisition decisions. As collectors become more sophisticated, they increasingly value the expertise and transparency that reputable galleries offer.

Regional dynamics provide global opportunities, with the United States maintaining its position as the largest art market at 43% of global sales. The UK's strong position at 18% market share, combined with growing interest from international collectors, creates favourable conditions for London-based galleries with global reach like Calder Contemporary.

Private sales have gained prominence as collectors seek discretion and assured outcomes. Auction houses reported 14% growth in private transactions in 2024, reflecting sophisticated collectors' preference for professional guidance and personalised service when acquiring significant works.

Expert guidance has become increasingly valuable as market complexity grows. As Sotheby's specialist Emma Baker observes, "Provenance plays a critical role; a well-documented history of an artwork, especially one that includes ownership by notable collectors or inclusion in prestigious exhibitions, can significantly increase its value." This expertise becomes essential for maximising both acquisition success and long-term appreciation potential.

Ensuring Authenticity and Provenance: Cornerstones of Blue-Chip Collecting

Professional authentication represents the foundation of confident blue-chip collecting, with rigorous verification processes protecting collectors whilst ensuring works maintain their market value over time. The sophistication of today's art market makes working with trusted specialists essential for navigating authentication successfully.

Certificates of authenticity serve as primary documentation, with their credibility depending on the issuing authority. COAs from artist estates, official authentication boards, or established galleries carry significant weight and provide essential market acceptance. For instance, authentication from recognised authorities like the Warhol Foundation (for works authenticated before 2011) provides crucial market validation.

Artist estates and authentication committees play vital roles in maintaining market standards. The Keith Haring Foundation continues authenticating Haring works, whilst other estates have established formal processes for verification. These institutions maintain comprehensive archives that provide definitive attribution confirmation.

Catalogue raisonnés represent the gold standard for authentication – these definitive listings of an artist's known works provide scholarly validation that significantly enhances market confidence and value. Having a work included in the official catalogue dramatically improves both saleability and long-term appreciation potential.

Provenance documentation traces ownership history from creation to present, serving multiple valuable functions simultaneously. Strong provenance not only confirms authenticity but also ensures legal ownership and often adds significant value through association with distinguished collections or exhibitions. Works with comprehensive provenance histories consistently achieve premium pricing in today's market.

Major auction houses provide five-year authenticity warranties, demonstrating their confidence in verification processes whilst protecting buyers. This standard warranty coverage reflects industry commitment to maintaining authentication standards whilst providing practical security for collectors making significant investments.

Scientific analysis increasingly complements traditional authentication methods. Advanced techniques examining pigments, canvas, and other materials ensure consistency with claimed creation dates and artist practices. Such sophisticated approaches provide additional confidence layers that enhance market acceptance and value preservation.

Calder Contemporary maintains the industry's highest authentication standards, working with recognised experts and utilising comprehensive verification methods including artist archives, certificates of authenticity, and scientific analysis when appropriate. Each piece undergoes thorough vetting before being offered for sale, with complete documentation provided to ensure collector confidence and optimal long-term value.

Our lifetime guarantee of authenticity reflects our commitment to maintaining uncompromising standards whilst providing the peace of mind essential for confident collecting. This comprehensive approach ensures that every acquisition meets the rigorous standards expected in today's sophisticated market.

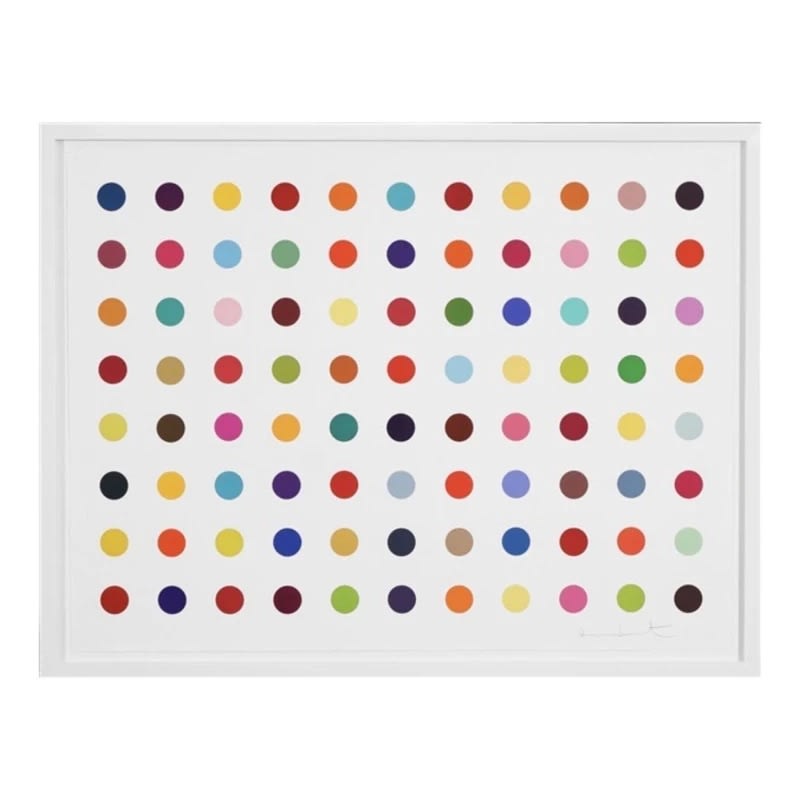

Damien Hirst - M-Fluorobenzoyl Chlorid for sale at Calder Contemporary

Strategies for Building Your Blue-Chip Collection

Developing a sophisticated blue-chip collection requires combining personal aesthetic preferences with strategic market considerations, creating a curated selection that provides both visual satisfaction and strong appreciation potential over time.

Quality consistently outweighs quantity in successful blue-chip collecting. A carefully chosen selection of works by established artists often provides superior long-term satisfaction and value appreciation than larger collections of lesser pieces. This principle applies whether focusing on specific movements, time periods, or artistic approaches – depth of engagement typically yields superior results to unfocused breadth.

Consider your collecting approach through multiple strategic lenses. Some collectors focus on particular movements like Pop Art, building comprehensive holdings of works by Andy Warhol, Roy Lichtenstein, and their contemporaries. Others prefer thematic approaches, exploring how different blue-chip artists address similar subjects across various periods.

Limited-edition prints and multiples offer excellent entry points into blue-chip collecting whilst maintaining connection to major artistic statements. A David Hockney print from his iconic pool series or a Takashi Murakami edition featuring his signature flowers provides meaningful exposure to these artists' work whilst building toward larger acquisitions over time.

Diversification across different media, time periods, and artistic approaches enhances both aesthetic interest and portfolio strength. Balancing works on paper with paintings or sculptures, combining established masters with contemporary stars, and mixing different scales creates dynamic collections that remain engaging whilst building value systematically.

The print market has demonstrated particular strength recently, with auction activity increasing 107% in 2023 compared to five-year averages. Complete sets and series often achieve exponential premiums over individual pieces, making strategic portfolio building especially rewarding for informed collectors.

Research and education enhance collecting satisfaction whilst improving acquisition success. Understanding an artist's career development, market history, and critical reception helps identify opportunities whilst ensuring optimal acquisition timing. Following market trends, exhibition schedules, and scholarly developments keeps collectors positioned for strategic decision-making.

Consider complete sets and series when opportunities arise. The market consistently rewards comprehensive portfolios, with complete sets often achieving significantly higher values than individual pieces sold separately. This principle applies particularly to artists like Damien Hirst, whose recent series demonstrate substantial appreciation when kept together.

Professional presentation significantly impacts both enjoyment and value preservation. Works should be expertly framed using museum-quality materials and displayed in appropriate conditions. This investment in proper care and presentation enhances daily satisfaction whilst protecting long-term value appreciation.

Mastering the Market: Buying and Selling Blue-Chip Works

Understanding primary and secondary market dynamics enables collectors to make strategic acquisition and disposition decisions whilst maximising both financial returns and collecting opportunities from their blue-chip contemporary art activities.

The primary market involves first-time sales directly from artists or their galleries, where pricing reflects careful market positioning rather than competitive bidding dynamics. Primary purchases often provide access to latest works and establish valuable gallery relationships that facilitate future acquisitions at favourable terms.

Secondary market transactions involve any subsequent resale of artworks, whether through auctions, dealer sales, or private transactions. Here, market forces determine pricing through competitive demand, often resulting in significant appreciation for desirable works by established artists. The secondary market provides essential liquidity whilst establishing transparent pricing benchmarks.

For blue-chip artists, secondary market values frequently exceed primary prices, sometimes dramatically. This dynamic reflects growing recognition combined with increasing scarcity as works enter permanent collections. Strategic collectors often acquire works in primary markets with realistic expectations of secondary market appreciation over appropriate time horizons.

Professional guidance becomes particularly valuable in navigating both markets effectively. Established galleries like Calder Contemporary provide comprehensive support for both acquisition and eventual disposition, ensuring optimal timing, pricing, and presentation that maximises results whilst maintaining works' market reputation.

Auction houses provide transparent price discovery, making them suitable for works likely to generate competitive interest. However, the public nature and fixed timing may not suit all situations, making professional consultation valuable for determining optimal selling strategies.

Private sales offer discretion and flexible terms that appeal to many collectors. Gallery-mediated private sales provide personalised service whilst avoiding public exposure that might affect future marketability. Professional handling ensures optimal presentation and buyer development that can achieve premium results.

For detailed guidance on secondary market strategies, including comprehensive analysis of resale dynamics and market timing considerations, collectors can explore our in-depth resource on mastering the secondary market for blue-chip art.

Market timing influences both acquisition and disposition success. Economic cycles, artist exhibition schedules, and cultural trends all create opportunities for strategic collectors who work with experienced specialists. Professional market knowledge helps identify optimal timing whilst avoiding less favourable conditions.

Your Journey in Blue-Chip Contemporary Art

Blue-chip contemporary art represents a unique intersection of cultural significance, aesthetic pleasure, and compelling financial characteristics. These works by history's most influential artists offer collectors the opportunity to own pieces that have shaped our visual understanding whilst benefiting from historically strong long-term appreciation potential.

The key to successful blue-chip collecting lies in combining passion with professional expertise. Understanding market dynamics, authentication processes, and strategic acquisition approaches enables collectors to make confident decisions whilst maximising both satisfaction and value creation. Quality, provenance, and professional guidance remain paramount considerations for achieving optimal results.

Calder Contemporary serves as trusted specialists dedicated to making elite art accessible through expert curation and transparent guidance. Our carefully selected inventory spans the full spectrum of blue-chip contemporary art, from iconic prints by established masters to select originals by internationally recognised artists. Each work undergoes comprehensive authentication and market analysis, ensuring collectors can acquire with complete confidence.

Whether you're building your first serious collection or expanding an established portfolio, our expertise in market dynamics, strategic timing, and professional presentation helps maximise both immediate satisfaction and long-term value creation. We provide detailed documentation, authentication guarantees, and ongoing consultation to ensure each acquisition enhances your collection's impact and appreciation potential.

The contemporary art market continues evolving, creating exceptional opportunities for collectors who work with experienced specialists. By focusing on quality, authenticity, and strategic guidance, collectors can build meaningful collections that provide lasting satisfaction whilst participating in one of history's most rewarding asset classes.

Current market conditions particularly favour collectors who combine aesthetic appreciation with strategic thinking. The flight to quality dynamic creates opportunities to acquire exceptional works whilst building collections positioned for long-term appreciation and enjoyment.

Contact our specialists for personalised guidance on building your blue-chip contemporary art collection, or explore our expertly curated selection of available works by today's most significant artists.

Frequently Asked Questions

Where to buy blue-chip art?

Blue-chip contemporary art can be acquired through established galleries like Calder Contemporary, major auction houses, and authenticated platforms. Reputable specialists provide authentication, comprehensive documentation, and expert guidance essential for successful collecting whilst ensuring optimal long-term value appreciation.

Is blue-chip art a good investment?

Blue-chip art has demonstrated compelling long-term performance, with the Artprice100 index outperforming the S&P 500 since 2000. Quality works by established artists provide both aesthetic satisfaction and strong appreciation potential, making them attractive for collectors seeking portfolio diversification and cultural engagement.

How to invest in blue-chip art?

Begin with education about artists, market dynamics, and authentication processes. Focus on quality acquisitions, establish relationships with reputable specialists, and consider starting with limited-edition prints before progressing to unique works. Professional guidance from established galleries ensures optimal acquisition strategies whilst maximising long-term success.